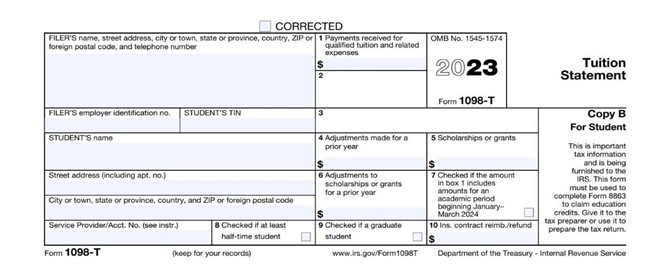

1098-T Information/Guide

IRS Form 1098-T, Tuition Statement provides information from educational institutions to students which may be of use in determining a student's eligibility for two tax credits, the American Opportunity Credit and the Lifetime Learning Credit.

To obtain your 1098T information, you may access it through Jagwire:

After logging in, navigate to:

- Student Services > Student Business Services > Print Tax Notification (1098T) > Select Tax Year